Welcome To Latest IND >> Fastest World News

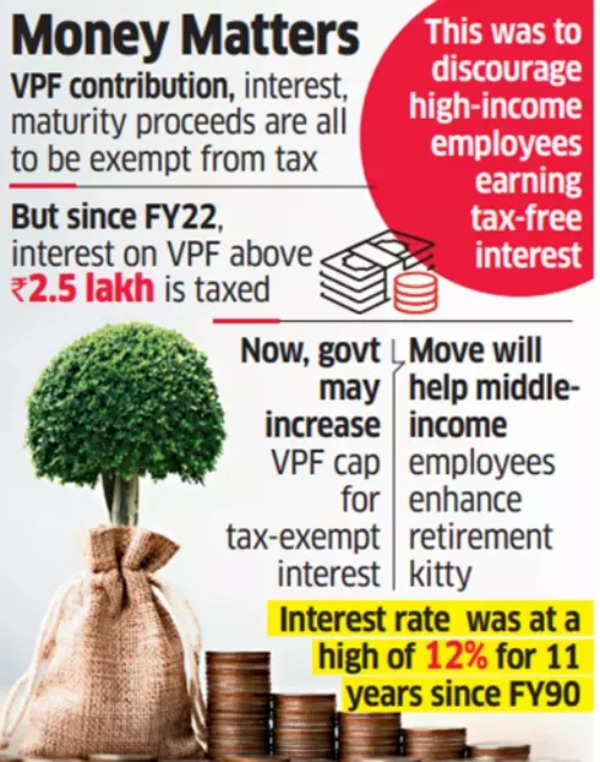

The Rs 2.5 lakh ceiling on voluntary contributions was introduced in the FY22 budget. (AI image)

VPF

limit for tax-free interest to be hiked? The government is considering increasing the limit on

voluntary provident fund

(VPF) contributions under the

Employees’ Provident Fund

Organisation (EPFO) that earn tax-free interest. Currently, interest earned on contributions above Rs 2.5 lakh is taxable.

The objective is to encourage lower-middle and middle-income salaried individuals to save more through EPFO, enabling them to build a substantial retirement corpus.

The ministry of labour and employment is examining the issue and may discuss it with the finance ministry during the FY26 budget deliberations, people familiar with the matter told ET.

The Rs 2.5 lakh ceiling on voluntary contributions was introduced in the FY22 budget to prevent high-income employees from using the facility to earn tax-free interest higher than that offered by banks or fixed deposits.

Budget 2025: Change in VPF rules?

VPF contributions, interest, and maturity proceeds are typically exempt from taxation. EPFO has been offering interest rates above 8% since FY78, reaching a peak of 12% in FY90 and maintaining that level for 11 years until FY2000.

The interest rates on PF accumulation were 8.10% for FY22, 8.15% for FY23, and 8.25% for FY24.

Under the current Employees’ Provident Funds & Miscellaneous Provisions Act, there is no limit on VPF contributions to the PF account, which can be up to 100% of basic salary and dearness allowance.

The government aimed to address the perceived misuse of this provision by high-income earners by capping the tax-free interest income earned on voluntary contributions at Rs 2.5 lakh per year.

EPFO has an average of 70 million monthly contributors, more than 7.5 million pensioners, and a corpus exceeding Rs 20 lakh crore.

Latest IND