Welcome To Latest IND >> Fastest World News

NEW DELHI: Direct overseas investment into India dipped marginally to $18.5 billion during April-Dec 2024, compared with $18.8 billion during the first nine months of the previous fiscal year, as overseas companies significantly stepped up repatriation from the country.

Latest data released by the Reserve Bank of India (RBI) showed that during April-Dec, repatriations or disinvestment from India shot up by $10.9 billion, or by a third, to $44 billion. In contrast, gross foreign direct investment flows were $10.7 billion or 20.5% to $62.5 billion.

Within this, equity inflows were pegged at $41.4 billion, 8.3% higher than April-Dec 2023, with reinvested earnings rising 17.4% to $16.9 billion.

A part of the repatriation could be on account of some of the investors, including the likes of Hyundai and investors in startups, selling their stake in Indian companies at the time of initial public offers and posting hefty gains in the process.

Govt has been focusing on stepping up gross inflows into the country, positioning India as an attractive investment destination at a time when overseas investors are looking at diversifying their manufacturing bases to reduce dependence on China.

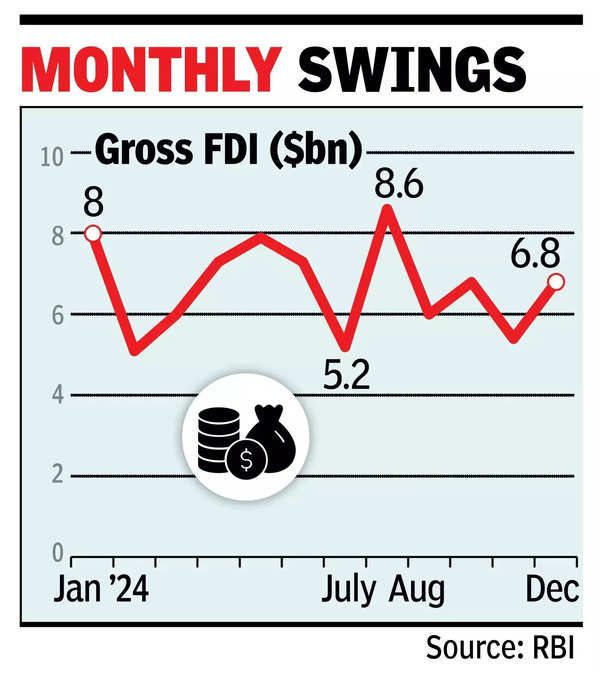

In Dec 2024, gross FDI inflows were estimated to have soared 48% to $6.8 billion, data released in the RBI Bulletin showed.

Based on the current run rate, analysts expect the gross FDI inflows to be higher than last year. India saw record inflows of nearly $85 billion in 2021-22 when there was a rush of investment in startups and telecom sector, led by Reliance Jio.

Latest IND