Welcome To Latest IND >> Fastest World News

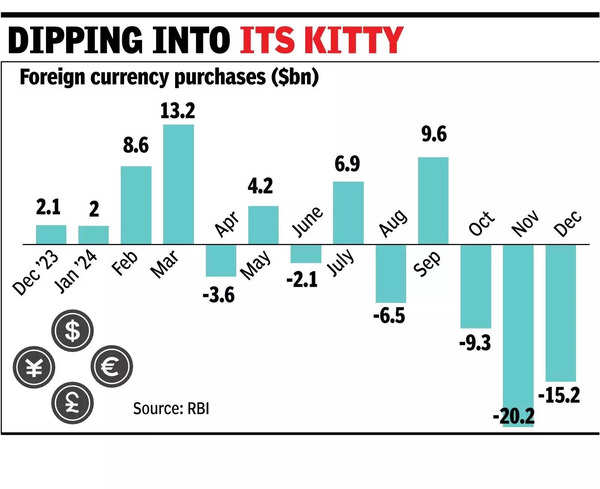

MUMBAI: The Reserve Bank of India’s (RBI) intervention in the

foreign exchange market

to stabilise the rupee resulted in net sales of $15.2 billion in Dec 2024, latest data released by RBI on Wednesday showed. This was a drop of $5 billion from $20.2 billion in Nov 2024 when the then President-elect Donald Trump stoked fears of a tariff war, resulting in significant gains for the US dollar.

In Dec 2024, RBI sold $69 billion of forex and purchased $53.9 billion in the spot market. The RBI’s net outstanding forward sales stood at $67.9 billion at the end of Dec, compared with net sales of $58.9 billion in the prior month, the data released in the RBI Bulletin showed.

RBI intervenes in the spot and forwards markets to check excessive volatility or very strong movement. In recent months, it has been stepping in actively to sell dollars, in the process, sucking out liquidity. A sharp depreciation, however, pushes up the import bill and exerts price pressure, especially for products such as crude and edible oil. RBI governor, who had recently reiterated the central bank’s policy on exchange rate management, had said that a 5% depreciation in the rupee resulted in a 30-35 basis point inflation in the domestic market.

While the intervention resulted in the rupee appreciating against a basket of 40 currencies, in Jan, the trade weighted real effective exchange rate, which measures the real competitiveness of the currency, was pegged at 104.82 as against 107.13, indicating weakening. A weaker currency is seen to be good for exports. RBI governor Sanjay Malhotra recently said that RBI is sticking to its policy on currency management.

While data is yet to be released, forex sales by the central bank had continued in Jan following record sales by

foreign institutional investors

. FIIs recorded significant outflows in Jan 2025, amounting to Rs 87,375 crore. This figure represents one of the highest monthly sell-offs in recent years.

Forex reserves had depleted by nearly $63 billion to $638 billion as of Feb 7, down from a peak of $701 billion in Oct 2024.

Latest IND