Welcome To Latest IND >> Fastest World News

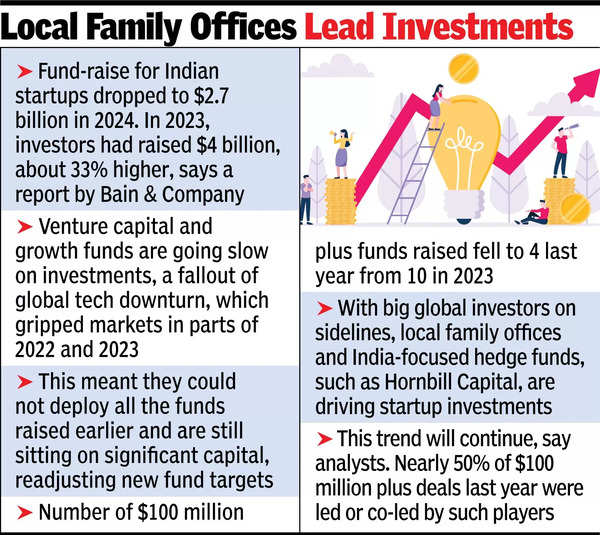

MUMBAI: The size of funds collectively raised by investors for allocating to

Indian startups

dropped to a four-year-low of $2.7 billion in 2024 as big players like

SoftBank

and

Tiger Global

refrained from making big bets, largely issuing smaller follow-on cheques for portfolio companies and remained cautious on overall deployment of capital.

In 2023, investors had raised $4 billion, about 33% higher, a report by Bain & Company and Indian Venture and Alternate Capital Association (

IVCA

) showed.

A global tech downturn, which had gripped markets in parts of 2022 and 2023 nudged

venture capital

(VC) and growth funds to go slow on investments — this basically meant that they could not deploy all the funds raised earlier and are still sitting on significant capital, readjusting their new fund targets.

Local family offices lead investment

“Leading VC funds had sizeable fundraises in 2022 and 2023 and deployments were measured in H2 (second half) of 2022 and 2023. Most of the top VCs did not see the need to raise another big fund,” Prabhav Kashyap, partner at Bain & Company told TOI.

In fact, the number of $100 million plus funds raised shrunk to four last year from 10 in 2023. VC firm Accel was an outlier though, having closed a $650 million fund to back local startups. “Fund-raising declined as top investors (barring Accel) tempered activity….crossover funds remain subdued. Tiger Global maintained its focus on backing existing portfolio companies without making new bets. SoftBank marked its return to Indian startups after an 18-month hiatus by exclusively funding existing investments,” analysts at Bain said.

To give a broader perspective, Tiger Global’s last venture capital fund closed in early 2024 and raised $2.2 billion, short of its initial target of $6 billion and lower than its previous $12.7 billion fund raised in 2022. “From a value creation and returns perspective, funds want to focus on topline growth and margin expansion, and not multiple expansion. In India, the valuation multiples are still elevated compared to most other markets despite a correction,” said Kashyap.

With big global investors on the sidelines, local family offices and India-focused hedge funds like Hornbill Capital are driving startup investments. And, the trend will continue, analysts said. Nearly 50% of $100 million plus deals last year were led or co-led by such players and a few emerging global VCs like StepStone and Glade Brook. Zepto’s $350 million funding in Nov was fully backed by domestic investors, including a clutch of family offices, while PhysicsWallah’s $210 million funding was led by Hornbill Capital.

Startup funding, which has been tepid so far this year is expected to pick up pace in the coming months. The subdued sentiment prevailing in the public markets has spilled over to private markets, leading to some cautious funding, analysts said.

Latest IND