MUMBAI: The share of

women home loan borrowers

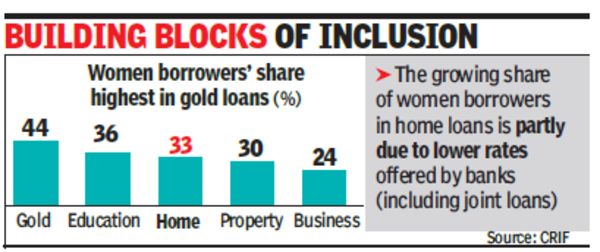

has increased marginally to 33% in 2023 from 32% in the previous year. Women’s representation in personal, gold and education loans too has inched up, data from

credit bureau CRIF High Mark

showed.

The growing

share of women borrowers

in home loans is at least partly due to

lower rates offered by banks

(including joint loans). Besides promoting inclusion, this means that properties are jointly registered, providing added security to lenders.

Women account for 16% of

personal loans

, compared to 15% in the previous year and 43% of gold loans – a rise from 41% in the year-ago period. In education loans, 36% of all active accounts are of women, up from 35% a year ago. Despite the increasing representation of women among borrowers in significant sectors, their proportion in the number of active retail loans has declined. Their share in the total value of loans, however, has remained steady over the past 12 months concluding in Dec 2023.

The drop in women’s share stems from the business loan segment, where the ratio of women-men borrowers has dropped to 38:62 from 40:60 a year ago. As a result, share of women in the overall volume of retail loans has fallen to 24% from 25% a year ago.

Incidentally, after gold loans, the share of women borrowers is highest in small business loans, where women constitute 43% of the borrowers. The portfolio outstanding for women borrowers in two-wheeler and personal loans increased 26% year-on-year. Personal loans saw a 52% annual increase in active loans, while property loans grew by 39%.

Retail loan portfolio reached Rs 117.4 lakh crore in Dec, up from Rs 100.3 lakh crore in the year before – a 17% year-on-year growth. Women borrowers’ share in retail loans remained stable at around 26%. Active women borrowers rose to 7.8 crore in Dec, up from 6.7 crore a year ago, with a 17.8% year-on-year growth. Male borrowers with active loans increased to 20.2 crore from 17.8 crore in Dec 2022, with a 13.1% year-on-year growth.

In terms of volume of loans, the business loan segment accounts for 6% of the total 59.6 crore retail loans. The largest retail segment in volume of accounts is personal loans (18% of retail loans), where the share of women borrowers has increased to 16% from 15%. In value terms, share of women in overall retail loans of Rs 117.3 lakh crore has remained unchanged at 26%.