FDI Reforms 2.0: The Indian government is currently reviewing the

foreign direct investment

(FDI) norms for crucial sectors such as

banking

,

insurance

, and

defence

, following recent relaxations in the space and satellite industries. Officials have stated that while most of the significant FDI reforms have already been implemented, discussions are underway to determine if conditions for these key sectors can be further eased.

Any potential changes will be made after the conclusion of the elections on June 1.

An official familiar with the deliberations told ET, “Some areas in finance and insurance, (and) even in defence, could still be looked at in terms of further reduction. Brainstorming is going on, but it has not reached anywhere.”

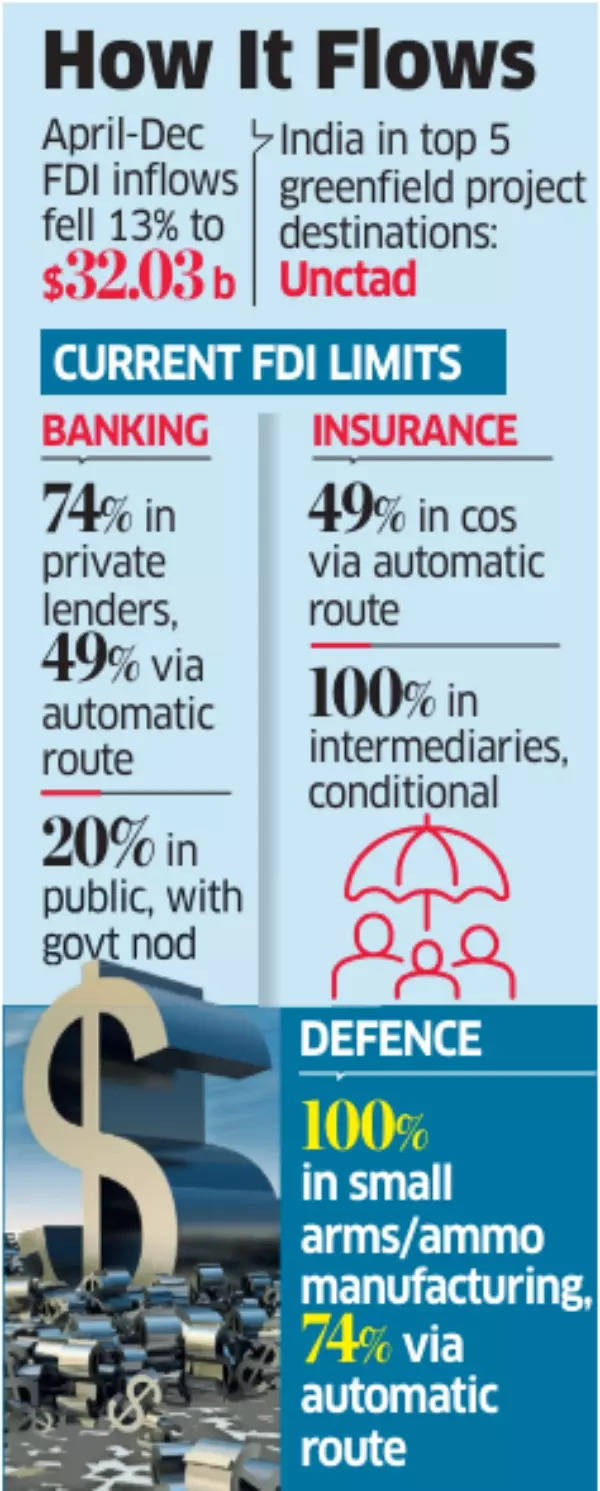

The final decision will be made after consultations among officials and stakeholders. During the period of April-December 2023, FDI equity inflows experienced a 13% year-on-year decline, amounting to $32.03 billion. The United Nations Conference on Trade and Development (Unctad) has attributed this slump in FDI in developing nations to weak investment and economic uncertainty.

FDI Limits

The banking, financial services and insurance (BFSI) sector, along with outsourcing and R&D, attracted the highest inflows, amounting to $5.18 billion during April-December 2023. The Indian government believes that the country should further relax its FDI rules, despite having a more liberal policy compared to some other nations.

An official stated, “We are more liberal than most of the Asean countries, which are generally considered very open.”

Currently, India allows 74% FDI in private sector banking, with up to 49% permitted through the automatic route and government approval required beyond that threshold. In public sector banking, the FDI cap is set at 20% through the government route.

Also Read |India’s Mission 2047: How India aims to become a developed economy – high speed expressways, electric mobility, digital payments & more

The insurance sector permits 49% FDI in insurance companies through the automatic route and 100% in insurance intermediaries, subject to certain conditions.

The defence industry is subject to industrial licence under the Industries (Development & Regulation) Act, with FDI allowed up to 100% in the manufacture of small arms and ammunition under the Arms Act, of which up to 74% is permitted through the automatic route, subject to conditions. Between April 2000 and December 2023, FDI equity inflows in the defence sector amounted to $16.38 million.