Welcome To Latest IND >> Fastest World News

New Delhi:

Mercedes-Benz

, the country’s biggest luxury carmaker, said on Wednesday that any changes to GST rates on electric vehicles will have an impact on the investment and employment of the zero-emission cars, while slowing down their sales.

The comments come at a time when the GST Council is understood to be discussing raising the GST rates on cars priced above Rs 40 lakh from the existing subsidised tariff of 5%.

Santosh Iyer

, MD & CEO of Mercedes in India, said this would be a negative for the industry and discourage luxury players to introduce new technologies and latest products.

“Any increase in tax will slow down the adoption of EVs,” Iyer told TOI while adding that the measure should not be considered either for cars being assembled locally or the ones coming in as fully-built imports (CBUs).

On any changes for CBUs, he said, “Fiscally it doesn’t make sense because these EVs are imported with 110% duty. So, govt already is getting a lot of duty from these cars. And if you now increase the GST, the sales and demand for these cars will surely come down and therefore from a revenue perspective, it will be neutral or even negative for govt.”

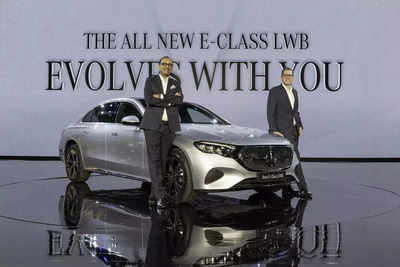

Iyer was speaking after launching the new long wheelbase E-Class sedan with prices starting from Rs 78.5 lakh (ex-showroom). The company also said its car sales in India grew over 13% year-on-year to 14,379 units in the first nine months of 2024, registering its best-ever performance in the period.

In the September quarter, the company delivered over 21% more cars at 5,117 units.

Elaborating on the GST issue on electrics, Iyer said getting in high-end imported cars that are laden with new technology has a “trickle-down” impact on the category of EVs as they encourage others to adopt the cleaner cars. “So the trickle-down effect will only happen when there are a lot of top-end cars and customers who are driving EVs. That gives a lot of confidence to also the mass-market customers and segments to shift to EVs.”

Also, he said that as the demand becomes healthy for the imported

luxury cars

due to lower duties, companies are encouraged to assemble them in India. “We have always brought in CBUs and over a period of time localized them. Let’s take an example of the S Class and Maybach which we initially imported but started assembling later once the market was there. So, any increase in taxation for these cars will mean that we will not be able to test these cars and then localize them. So, overall I think we would expect the current situation to continue from the policy perspective.”

Iyer also said that it does not make sense to consider hiking GST for electrics being assembled locally. “It doesn’t make any sense to even consider locally-produced EV cars (for a GST hike) because it has a direct impact on the investment, employment and everything else.”

Latest IND