Welcome To Latest IND >> Fastest World News

MUMBAI/CHENNAI:

UltraTech

Cement, controlled by Kumar Mangalam Birla, has acquired a 23%

stake

in

India Cements

from veteran investor Radhakishan

Damani

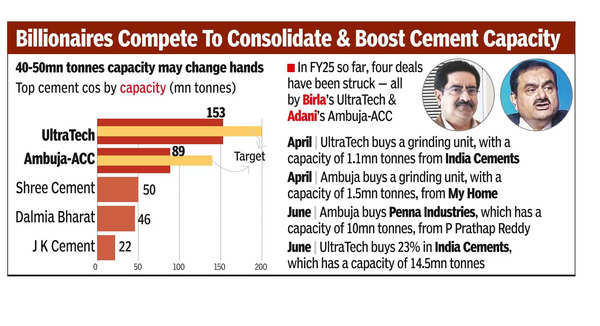

for Rs 1,885 crore. The move intensifies UltraTech’s rivalry with Gautam Adani’s Ambuja Cements and ACC as both seek to challenge its position as India’s largest building materials maker. The transaction positions Birla as the second-largest shareholder of the Chennai-based India Cements, behind the founders, N Srinivasan and family, who hold 28%.

UltraTech, the world’s third-most-valued cement company, described the deal as a “non-controlling financial investment”, acquiring shares at Rs 267 each — a 9% discount to the stock’s Thursday closing price on BSE.

The 23% stake, which does not include a board position in India Cements, is a little shy of the threshold requiring an acquirer to make an open offer to public shareholders under the country’s takeover code. Despite Srinivasan and family owning 28% in India Cements, 46% of that is pledged, according to the company’s filings with the stock exchanges.

This transaction marks the exit of Damani, who is also the founder of retail chain DMart, from India Cements, where he first invested in fiscal 2020. Over the years, he had increased his stake to 22.8% from a little over 1.3%.

Bulk deal disclosures on BSE showed that Damani, his brother Gopikishan, and three related associates offloaded their entire stake.

Former Ambuja Cements CEO and founder of advisory firm I can Investment Anil Singhvi views the deal as a “preventive and proactive strategy” by UltraTech. “It is like a toe in the door and wait until the door opens,” Singhvi said, adding that “this is a good deal for the sellers as they were stuck in this for a long time and have got a reasonably good value and complete exit.”

The transaction values India Cements, which has a capacity of 14.5 million tonnes, at Rs 10,800 crore. Industry analysts believe that this investment could be a prelude to UltraTech, part of the

Aditya Birla

conglomerate, potentially increasing its stake and eventually converting India Cements into a strategic asset. The India Cements investment and the Kesoram

acquisition

will help UltraTech guard its turf in the southern region, especially as the

Ambuja-ACC

combine attempts to ramp up its presence there. A few weeks ago, Ambuja-ACC bought Penna Cement, seeking to strengthen its southern grip.

The UltraTech investment comes at a time when India Cements is facing rough weather. In recent quarters, it has struggled to meet its working capital needs. Despite narrowing its losses, it has decided to sell certain assets to raise funds. In April, India Cements sold its grinding unit in Maharashtra to UltraTech for Rs 315 crore.

Under Birla’s leadership, UltraTech has become India’s largest cement player with a capacity of 153 million tonnes. When he took over as chairman of the Adi tya Birla Group in 1995, the cement unit’s capacity was less than 5 million tonnes. The sector, expected to double to $49 billion by 2029 from 2022 levels, has long been dominated by UltraTech until Adani entered the market by acquiring Ambuja-ACC in 2022, making him the country’s second-largest player. Ambuja ACC currently has a capacity of 89 million tonnes after expansions and acquisitions of smaller assets.

In a June 13 note, ratings agency ICRA said it expects mergers and acquisitions to continue in the sector, given the aggressive expansion plans of large incumbent players who want to maintain their market shares. Broking firm Emkay said Thursday that it sees at least 40-50 million tonnes of cement capacity changing hands over the next few years.

Latest IND