Welcome To Latest IND >> Fastest World News

MUMBAI: India’s economic growth is likely to improve in the second half of the current fiscal, driven by festive activity and an upswing in

rural demand

, RBI’s state of the economy report said. It also expects a moderation in the prices of food items, including rice, pulses, and vegetables.

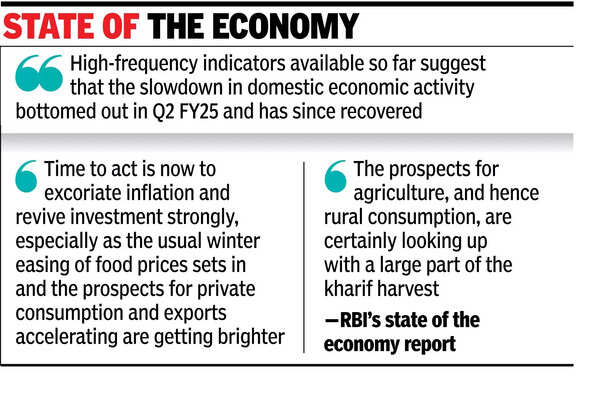

“Going forward, high-frequency indicators available so far suggest that the slowdown in domestic economic activity bottomed out in Q2 FY25 and has since recovered, aided by strong

festive demand

and a pickup in rural activities. Agricultural growth is supported by healthy kharif crop production, higher reservoir levels, and better rabi sowing. Industrial activity is expected to normalize and recover from the lows of the previous quarter,” the report said.

For Indian policymakers, the report suggests that this is the right time to support growth. “The time to act is now to excoriate inflation and revive investment strongly, especially as the usual winter easing of food prices sets in and the prospects for private consumption and exports accelerating are getting brighter. The prospects for agriculture, and hence rural consumption, are certainly looking up with a large part of the kharif harvest,” the report, co-authored by RBI deputy governor Michael Patra, said.

On the external front, the report notes how the “mercantilist rhetoric” from the incoming Donald Trump administration in the US is pushing down the value of all currencies against the dollar.

The report also notes challenges faced by China. “China’s long-term bond yields grapple with Japanification as they have fallen below Japanese yields, with wider implications for financial stability.”

Warning of the firming up of trade tensions, the authors said there could be broader spillovers in the form of “engineered devaluations of currencies, national self-interest in reshoring supply chains and critical materials, tariff-struck countries moving their companies overseas, and fractures in the world of finance.”

In India, the report expresses concern about the slowdown in government capital expenditure and suggests that fiscal spending, including on capital expenditure, could be hindered by the slowing rate of nominal GDP.

According to the authors, India’s GDP growth is projected to recover to 6.8% and 6.5% in Q3 and Q4 of 2024-25, respectively. Growth for 2025-26 is projected at 6.7%, while headline CPI inflation is projected to average 3.8% in 2025-26.

While acknowledging some moderation in consumption growth, the report highlights several positive factors, such as strong rural demand, recovering urban demand, and an increasing preference for quick commerce platforms. This implies that policies supporting consumption could further boost growth.

Latest IND