International credit card

spending new rules soon? If you are planning a foreign holiday, then you may have to take note of the

liberalised remittance scheme

cap for international credit card spends from April 1, 2024. Banks in India are gearing up for a possible change in the rules regarding international credit card spending. The banking regulator has instructed banks to be prepared for the inclusion of such spending in the liberalised remittance scheme (LRS) by April 1.

According to an ET report, this plan, which was put on hold for a year, could soon come into effect.

The

Reserve Bank of India

(RBI) is working closely with banks to ensure a smooth transition. The move aims to regulate overseas credit card transactions within the existing remittance limits.

New LRS rules for International Credit Card Spending:

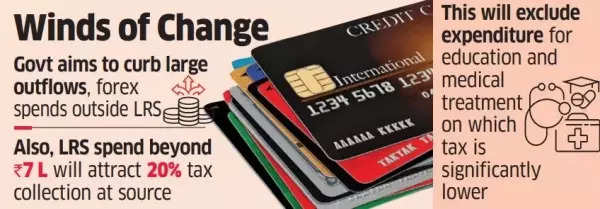

- Under the proposed changes, international credit card expenses incurred while traveling abroad will be counted towards the annual cap of $250,000 allowed for remittances under the LRS.

- Additionally, any spending beyond Rs 7 lakh will attract a 20%

tax collection at source (TCS), with certain exceptions for education and medical purposes where the taxes are much lower. Individuals may be eligible for a tax refund if the TCS amount exceeds their total tax liability.

The new regulations are seen as part of the government’s broader strategy to curb excessive

foreign exchange

outflows and restrict high-value expenditures made through international credit cards. However, banks are seeking clarity on how to differentiate between personal and business expenses, as well as between overseas card usage and online transactions made in India for services like hotel bookings.

New international credit card rules

Industry experts suggest the need for a more nuanced approach. “In the era of ease of doing business, where the government’s aim is to encourage manufacturing in India and promote export of goods, a broader mindset is required in controlling foreign exchange outflow rather than restricting spending through credit cards,” Siddharth Banwat, CA and co-founder at Yuvyze Consulting LLP was quoted as saying.

According to him, creating a separate limit for foreign exchange spending via credit cards, in addition to the existing remittance cap may help. This, he says, would streamline the reporting process and eliminate the need for TCS on credit card transactions within the LRS limits.

There are challenges ahead, particularly in enforcing the segregation of expenditures. High net-worth individuals (HNIs) may explore alternative methods to circumvent these restrictions, such as utilizing unofficial channels or engaging in reciprocal arrangements with acquaintances. The recent budget amendments related to TCS on LRS payments and overseas tours have prompted a reassessment of credit card regulations. While the government initially planned to implement these changes earlier, the lack of preparedness among banks and card networks led to a delay in their enforcement.

As the deadline approaches, banks are working diligently to align their systems with the new guidelines to ensure a seamless transition for customers.