Welcome To Latest IND >> Fastest World News

Adani Group Chairman Gautam Adani

MUMBAI/NEW DELHI:

Adani Green Energy

said Wednesday that Gautam Adani,

Sagar Adani

and Vneet Jaain have not been charged with any violation of the

Foreign Corrupt Practices Act

(FCPA) on the counts mentioned in the criminal indictment of the

US Department of Justice

(DoJ) or the civil complaint of the US Securities and Exchange Commission (SEC).

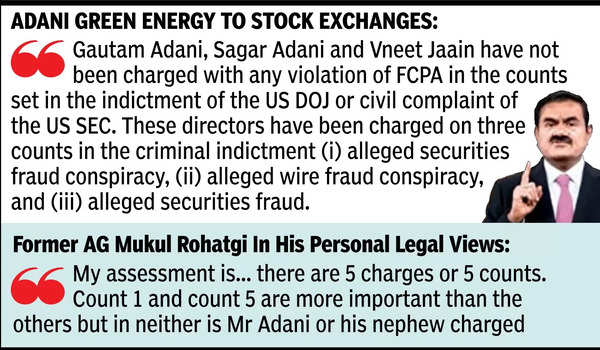

“These directors have been charged on three counts in the criminal indictment namely alleged securities fraud conspiracy, alleged wire fraud conspiracy, and alleged securities fraud,” the company said in a stock exchange filing, refuting media reports that had quoted DoJ documents to say the directors were charged with breaching FCPA.

Former Attorney General and senior counsel Mukul Rohatgi addressed a news conference early Wednesday to also say neither Gautam nor Sagar Adani was charged in two crucial counts.

‘Took $55bn mcap hit since indictment’

Clarifying that these were his personal legal views and that he was not a spokesman for the Adani group (but had appeared for it several cases), former Attorney General Mukul Rohatgi on Wednesday said, “My assessment is and it is clear that there are 5 charges or 5 counts. It is very important to note that count 1 and count 5 are more important than the others but neither in count 1 nor in count 5 is Mr Adani or his nephew is charged.”

“So count 1 contained in paras 124 onwards of the indictment is against certain other persons minus the two Adanis. It includes some of their officers and one foreign person, that is the conspiracy to violate the Foreign Corrupt Practices Act. It is called FCPA. It is somewhat similar to the Prevention of Corruption Act in India,” said Rohatgi.

The penalties for the other three charges are less severe than those for corruption charges. The Adani group had previously denied all allegations and said it would seek legal remedies. In a separate note, Adani group said since the indictment, it has suffered a loss of nearly $55 billion in its market capitalisation across its 11 listed companies.

Last week, US prosecutors had indicted billionaire Gautam Adani and his nephew and former executives of Canadian pension fund CDPQ and Azure Power for their alleged role in a $265 million (Rs 2,000 crore) bribery case to secure solar power supply contracts in India, putting the edible oil to ports giant in the midst of a second major controversy in 22 months. The DoJ and SEC have issued a criminal indictment and brought a civil complaint against the three directors of the company. Adani Green also said on Wednesday that the US criminal indictment has not quantified any fine or penalty. However, its three directors face monetary penalties under the civil complaint but the amount has not been specified.

On Nov 20, the DoJ indicted Gautam Adani and other defendants with “conspiracies to commit securities and wire fraud and substantive securities fraud for their roles in a multi-billion-dollar scheme to obtain funds from American investors and global financial institutions on the basis of false and misleading statements”. Jaain is not included in count 1.

Latest IND