MUMBAI:

Sebi chief

Madhabi Puri Buch on Monday flagged “

froth

” in small and mid-cap stocks, referring to “off the charts”

valuations

in these market segments. She also said that there are signs of

price manipulation

in small and medium enterprises segment.

The markets regulator is willing to review norms that mandate small and mid-cap funds to invest 65% of their assets in these stocks if it’s necessary to promote

risk management

, she said.

Her comments come at a time when the small and mid-cap shares have outperformed major indices. Many

mutual funds

have stopped accepting

lump sum investments

due to fear of overheating in the segment.

Sebi will release a format for mutual funds to disclose

stress test outcomes

this week. These tests will determine the time needed to liquidate investments in response to redemption pressure.

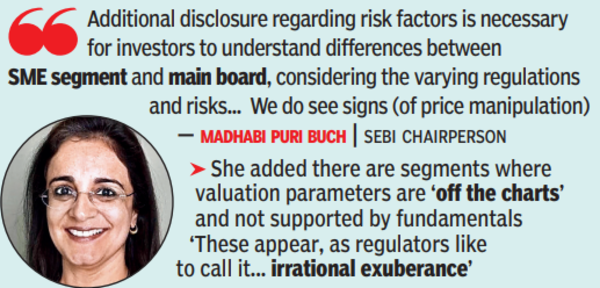

Buch said there are segments where valuation parameters are “off the charts” and not supported by fundamentals. “These appear, as regulators like to call it… ‘irrational exuberance’,” Puri Buch said, while speaking at MF industry body Amfi’s event.

The markets regulator will also implement more disclosure requirements for the SME segment. The BSE SME IPO index fell over 2.3% after the Sebi chairperson’s comments. The SME segment is seen as the weak link in the market because of the slack that has been allowed to the small businesses to enable them to raise money from the capital market without the onerous requirements that larger companies are subject to.

The exchanges (BSE & NSE) created separate platforms for listing of small businesses (SMEs) in 2012 after the regulator relaxed norms to enable such enterprises to list. There has been a surge in SME listings in the last 12 months.

She said that while the regulator aims to facilitate a less stringent listing environment for SMEs, there have been instances of misuse. “It is clear that additional disclosure regarding risk factors is necessary for investors to understand the differences between the SME segment and the main board, considering the varying regulations and associated risks,” said Puri Buch.

She said that the regulator is working to “evidence” the price manipulation of MSME stocks during trading. “We do see the signs; we have the technology to do so. We can observe certain patterns. According to regulations, we must construct the entire pattern and do so in a robust manner. Fortunately, the market has provided us with feedback on what we can do to identify and address such cases,” said Puri Buch.