Welcome To Latest IND >> Fastest World News

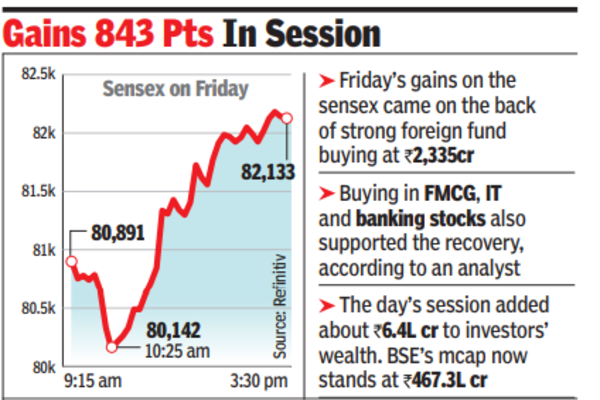

MUMBAI: Dalal Street witnessed huge volatility on Friday, with the sensex swinging over 2,100 points in intraday trades and finally closing 843 points up at 82,133 points – a two-month closing high. The day’s gains came on the back of strong

foreign fund buying

at Rs 2,335 crore, BSE data showed.

The sensex opened Friday’s session marginally lower at 81,212 points but soon, strong selling pulled it down to 80,083. Soon after, a strong recovery started that, during the closing minutes, took it to an intraday high of 82,214 points and it closed just a tad off that mark, up 1% on the day.

According to Siddhartha Khemka, head of research (wealth management) at Motilal Oswal Financial Services, buying in FMCG, IT and

banking stocks

supported the recovery, even as broader market sentiment remained cautious. “The intraday selloff in

Indian equities

followed weakness across Asian markets, which posted steep losses amid a stronger dollar, rising

US Treasury yields

and continued skepticism over China’s economic revival. The lack of clarity in China’s stimulus plans weighed on metal stocks in India,” he said.

Although foreign funds were net buyers during the session, market players are still not convinced the buying will sustain the short term. “US Treasury yields have surged to their highest levels this year, dampening hopes for significant Federal Reserve rate cuts going ahead. The rupee hit a new low of Rs 84.88 per dollar on Thursday, pressured by a strong dollar, FII outflows, and higher crude oil prices. Investors will watch out for manufacturing and services PMI of US and India and domestic WPI inflation to be released on Monday,” that could decide the market’s trend going ahead, Khemka said.

At close, of the 30 sensex stocks, 26 closed with gains. In the broader market, however, declines outnumbered advances with 2,173 laggards to 1,818 winners, BSE data showed.

The day’s session added about Rs 6.4 lakh crore to investors’ wealth, with BSE’s market capitalisation now at Rs 467.3 lakh crore.

In the short run, a host of domestic and global factors would decide the market’s trajectory. “Despite an adverse base effect, IIP growth in Oct 2024 improved marginally to 3.5% (from 3.1% in Sept). Impact of the US economic policy, recovery in domestic consumption & investment and CPI inflation are some factors to focus on over the next few months,” Shrikant Chouhan, head of equity research at Kotak Securities, said.

Market players also said that once Donald Trump takes office as the US President in Jan, the new administration’s policies would be in focus too.

Latest IND