MUMBAI: Axis Bank MD & CEO

Amitabh Chaudhry

completed five years as the bank’s head in Jan 2024. One of his key initiatives, developed over the past three years, is a

tech platform

that equips

frontline staff

with a super app, enabling them to carry their bank workstation in their pocket. Chaudhary said that given the deposit constraints, the bank would need to put curbs on businesses that do not meet the bar on

risk-adjusted returns

. In an interview with TOI, he discusses the road ahead. Excerpts:

What is the status of the growth and profitability strategy? Has the bank achieved its potential?

If you look at the humongous opportunities in financial services and India, the bank has a long way to go. As far as putting the bank on a certain platform and cleaning up our books, we have done a lot of work. Our 18%

ROA

(return on assets) target has been achieved and I think we can still do a better job in terms of ROI (return on investment). Generally, across business, we need to infuse more capital on technology to get better on our retail assets, and we are yet to take full advantage of all the tech that we have introduced on the wholesale side. The expectations of the regulator in terms of investments in compliance technology and cybersecurity have also gone up.

Which part of the business would grow disproportionately?

We’ve pretty much reached an equilibrium. Retail will be 50-60%. We prioritise based on return on capital and risk-adjusted returns because of deposit constraints. Some businesses will be allowed to grow as much as possible, while some may need to be throttled because we can’t spoil our balance sheets just to grow.

How are you going to prioritise businesses?

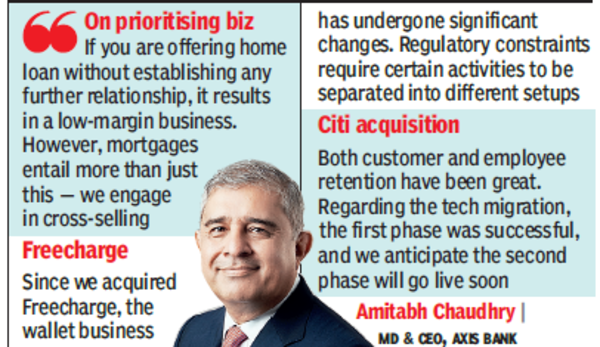

To provide a straightforward example, if, in a retail mortgage scenario, you are only offering a loan without establishing any further relationship, it results in a low-margin business. However, mortgages entail more than just this – we also foster relationships and engage in cross-selling. This is why the risk-adjusted return on capital, which takes into account all these factors, holds significance.

You announced several projects… how are they playing out?

Project Triumph is about creating and institutionalising a defined way for the entire deposit franchise to work on a day-to-day basis. We’re instituting a structured routine and transforming the culture. Siddhi (a superapp for employees) acts as the technological enabler. It encompasses diverse customer journeys and service capabilities. It furnishes frontline staff with essential information on their devices, enabling immediate assistance to customers who may encounter issues or require services during interactions. Neo symbolises our goal of becoming the top digital wholesale bank in India.

Has the war for deposits changed branch strategy

We have said that we will continue to establish branches for some time. When gathering deposits from a locality, the expectation is that you need to establish a physical presence, such as a branch, even if customers don’t frequently visit them. This year, we intend to open 500 branches, of which 380 are already operational. Next year, we plan to open 400-500 branches, and we have already identified the locations. Hopefully, at some point, the rate of branch openings will decrease.

How are Axis Pay and Freecharge contributing to business?

Since we acquired Freecharge, the wallet business has undergone significant changes. We pivoted Freecharge to serve as a digital sourcing arm for Axis Bank. Additionally, regulatory constraints require certain activities to be separated into different setups. With Freecharge we are expanding our merchant network and offering a wider range of services, including current accounts and loans, beyond QR codes. Once we complete the regulatory requirement of separating payment aggregator and payment gateway business, we will commence fresh onboarding and scale up operations.

You have been partners with Paytm earlier. Are there new opportunities?

We have their nodal account. They have UPI handles and the flows that come through. They also have a vast merchant network with deep relationships and are involved in the Fastag business. Paytm is likely in discussions with banks to explore suitable arrangements. If we finalise an agreement and have any announcements, we will do so.

How has the Citi acquisition worked for Axis Bank?

We paid a good price and acquired a business that complemented our operations. We are ranked number four in cards, but we have moved closer to number three following the acquisition. We are positioned as number two to three on a month-to-month acquisition basis. Citibank’s call centre was regarded as its key strength. We are expanding our call centre team, and our employees will handle calls for a specific segment of credit cards. Both customer and employee retention have been great. Regarding the tech migration, the first phase was successful, and we anticipate the second phase will go live soon.